Various dictionaries or even Wikipedia describe label as a piece of paper, plastic or another substrate affixed to a product giving information about it. The label has now attained a broader perspective. It has become the bridge between the end user and the producer. It can be embellished such that it becomes the sales enhancer, reaching out and tempting the end users to lift it off the shelf. It also has features that communicate with the cashiers in retail, the finance persons for accounting, the logistics department, the purchase department to fix reorder levels, facilitate ecommerce and much more. The label is also the guard for consumers, providing information of authenticity to them as also aiding the track and trace process to put a check on counterfeiting. Surely the label is a very important and sensitive part of any product, without it the products have no value, no recognition and no safety. In earlier times it was just a piece of paper with a simple letter press printing and affixed with the help of glue to the product. Printing technologies have evolved and become advanced, moving into different tangents providing a plethora of printing options ranging from the lithography in earlier times to screen printing, offset printing, Rotogravure printing, flexo graphic printing, several types of digital printing and so on. Similarly diverse labeling technologies to affix the labels on to products have been developed, moving away from the glue applied or wet glue labels mentioned above.

The labeling technologies in use now include;

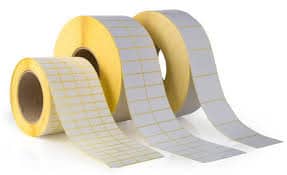

- Pressure Sensitive Labels or Self-adhesive labels

- Wet glue or glue applied labels

- Shrink Sleeves

- In-mold labels

- Heat transfer labels

- Direct printing on product labels

- Others

Market size: The total global label market size has been estimated by various evaluators and market research companies to be around 45 to 55 billion square meters and estimated to reach 65 to 70 billion square meters by 2025 growing at a CAGR of 4-5%. Asia Pacific remains the region registering biggest growth. Pressure Sensitive Labels have emerged as the most widely used segment of the labels at 50 to 60% of all the labels used. This is followed by around 25-30% of Wet glue labels, less than 15% for Shrink Sleeves and less than 4% of IML. The constant growth in the demand for labels is fueled by the innovations in printing, converting and application technologies some of which are driven by the need for environmental concerns and sustainability imperatives.

Pressure Sensitive adhesive labels: If we look back into history of label usage in India, until the mid-1960s it was just the wet glue labels that were in use and registering continual growth in the quantum of labels in use. All labels were applied by starch or other natural gums-based adhesives. When automatic label applicators started being used to label, due to warping and slow drying issues, high solids dextrin based adhesive and synthetic resin adhesives started being used. With advent of development pressure sensitive adhesive labels in the late 1960s as stickers in sheet format the journey of these PSA labels began but it was not until the mid-1970s that the stickers started being produced as labels in roll form to be dispensed in high-speed label applicators in automated packaging lines. The ease of use, options to also use other than paper substrates, better aesthetics and ongoing developments in printing, converting and decorating technologies inline in a single pass, brought rapid growth to PSA labels usage. The continual growth has taken the market size of PSA labels way past the 50% mark of the quantity of total usage of labels. At the onset of a new millennium there was talk of the impact of the liner and label matrix waste going to landfills and at this time alternative technologies started evolving. By the second decade the environmental and sustainability became a necessity to implement and indulge in alternative labelling technologies. Linerless labels has made some headway, but it remains a PSA label technology that still has to evolve to reach acceptability by end users

Wet glue labels: Traditionally this was the predominantly employed labelling technology but with the advent of PSA labelling, it lost a lot of ground to it. Unlike PSA labels that are applied by contact and pressure, in wet glue labels the glue is mechanically applied before application and left to dry on the moving packaging belt before going into final cartons. The need for clean room requirements and safety standards implementation in production areas of pharma and food companies, made end-users and brand owners of pharma and fmcg companies move away from wet glue labelling which required the continuous cleaning of applicators and production shop floors due to dripping adhesives attracting dust and bacteria. The growth in wet glue even though positive but is being slower than that of other technologies, it is losing the eventual market share. Presently when there is growing awareness of liner and matrix waste going to landfills impacting the environment adversely, wet glue labels application technology may undergo technical changes towards ease of use, be sustainable, cost effective without the liner and become a preferred technology. However, it is a little premature to expect a substantial change in this labelling. Major users of wet glue labeling are beer, liquor and wine producers.

Shrink Sleeves: These labels are printed on a flexible shrink film that reduces in size on application of heat and conforms tightly to the shape of the container or product, creating a colorful label with 360-degree coverage. These though originated in the mid-1930s as a cap seal for milk bottles, but it was between 1961 and 1980 due to pioneering work done by Fujiseal that the shrink sleeves attained full size labels shape for commercial usage. In 1991 Mumbai Headquartered, Paper Products Limited which is now Huhtamaki India Ltd., under license from Fuji Seal for shrink sleeves started manufacturing these in India. Heat shrinkable specially formulated PVC has been the most used polymer but now due to toxicity issues linked to PVC, usage of PE and PET have increased. The global market size for shrink sleeves estimated by many market research companies is more than 11 billion US Dollars growing at a CAGR 0f 6.5%, but the author’s opinion is that in India it is growing at over 10%. Earlier all the shrink sleeves were printed on rotogravure printing equipment which means only very large print runs were needed because the cost of heavy and wide rotogravure printing cylinders needed long setup times. All that has changed, now shrink sleeves are also printed on Flexo and digital presses making very short runs possible thereby providing an impetus to the demand of shrink sleeve labeling.

In-Mold labels (IML): Paper or film printed labels (mostly filmic) are placed inside the molds during the blow or injection molding process. After placing the label, molten plastic is injected or blown into the mold. On cooling the label is fused with the resin, takes the shape of the so molded container and becomes an integral part of it. This needs no affixing and no use of any applicators providing an extreme ease of use for the end user of products like Lube oils, Paints, Ice creams, Butter, Cooking oil, Food products, etc. These labels that debuted sometime in the late 1970s can be printed by diverse printing methods but in recent times there has been extensive use of flexographic printing for IML. The IML segment is environment friendly and sustainable. As no adhesive or release liner is in use. In fact, if the polymer of the label and the container is same family, recyclability is possible leaving no adverse impact on the environment. The growth of this segment in India again appears to be much in excess of the global estimation of 5.5%. Many container manufacturing plastic molding companies in India have started to produce their own in-mold labels in-house for captive consumption and use robotics to place the labels in the molds before the molding. Hyderabad head quartered Moldtek and Kapcones, Delhi are some of the prominent IML containers and in-mold label manufacturers in India.

Heat Transfer Labels: Heat transfer is a labelling technology originally branded as Therimage, was developed in the 1960s by Dennison manufacturing Company USA, in which only the reverse printed label on film or paper are transferred on to containers, using heat and pressure. Only the printed image without any substrate is transferred. Dennison manufacturing Company was later acquired by Avery International Corporation and the company was renamed Avery Dennison. These labels are printed by rotogravure printing process and transferred with help of Therimage heat transfer applicators. Evolution may soon see adaption of this technology by flexo and digital label printers. Once applied, the labels are permanently adhered to the container, they are sustainable as the containers can be recycled without removing the labels. Pens and other small radius containers use this technology because a decorated image is transferred without the problem of edge lifting of label face as in self-adhesive labels, on tightly curved containers or products. The technology provides a seamless, aesthetic, “no-label” look and offers 360 degrees print visibility. In the early days of the new Millennium, Dabur’s Chyawanprash containers were printed with this technology, at that time licensed by Avery Dennison who later sold the division to MCC (Multi-Color Corporation) the global producer of labels.

Direct printing labels on product: This direct printing on products appears to soon become a disruptive technology, when evolved and ready for widespread usage it would do away with all substrates and adhesives while printing multicolor images digitally and variably directly on the packages or products. There are multiple technologies that can do the direct printing. Some of these that already exist include screen printing which has been extensively used earlier on flat surfaces and even on plastic containers but with development and need for highly decorated labels the screen printing had to take a back seat. Pad printing that uses a silicone pad to lift inked images from an etched plate and transfer them to the products is also in use but being a slow and simple printing technology, it’s use is limited to simple images. Contact printing using polymer type faces on a roller printing on cartons was in use for long but the use of monochrome inkjet printers did not let this technology expand more. The most disruptive development that is being seen and when fully developed to find extensive usage is multi-color digital printing and embellishing directly on containers, packages and cartons. The shortcoming at this time is the cost of consumables which with increasing volumes are expected to recede. It will not be very long before we start seeing this happening extensively doing away with face papers, release papers and adhesives to a great extent.

Surely, despite these technologies appearing to be disruptive yet one can safely express that all these divergent technologies will still co-exist, and some may be complementary to each other.

The company is a total solutions provider to the label industry representing global brands supplying high-end Label presses, Inspection Systems, Allied converting equipment, Tooling, etc. Weldon also does custom coating and converting, produce Silicone Release, Papers A4 inkjet/laser label materials, Tamper Evident Label Materials and specialty tapes as a part of their manufacturing program.