EcoBlue Limited is a recycling company based in Thailand that has been working with different types of plastic wastes since 2013. For EcoBlue, sustainability lies at the core of all our activites and product offerings. On one hand, we work towards Circularity of Resources by bringing in difficult to recycle materials like films and laminates in the recycling stream. This enables materials which would have otherwise ended up in landfills to get a second life and reduce its impact on the environment. On the other hand, we have developed unique capabilities to produce high quality rPET & rPP from industrial and post-consumer waste, providing a sustainable alternative material to virgin resin that can be used in many applications.

Sustainability is gaining importance among all stakeholders and has become a key focus area for companies and regulatory bodies. Big multinational brands like Nestle, Unilever, Coca-cola are announcing their global pledges for sustainability either voluntarily or upon recommendation of EU. Recycled content and recyclability in packaging is increasingly becoming a part of the brand strategy. Governments across the world are becoming an active participant in setting out the expectations, formulating regulations and defining action plans for achieving a more sustainable tomorrow.

EcoBlue has been working to develop rPET grade suitable for food contact applications over the past few years. We have received a Letter of No Objection from US FDA for our rPET for food contact use. Being a part of the recycling industry over these years and also working on developing rPET grades suitable for food contact, has given us first hand experience of the various elements at play in the recycling industry in the region. We would like to share with other stakeholders involved the pertinent factors that we feel have an influence on improving circularity of plastics in Asia.

1. Legislation to promote the use of recycled plastics:

There are several countries where the recycling rates are successfully increasing. This can clearly be traced back to legislations promoting the use of recycled plastics. The actions can be classified into:

a. Reporting of plastic usage:

The first step to ensure that we are on the right track is to ensure that all companies report on the volume of plastic consumed by them in different forms (packaging, electronics, automotive, household goods etc.) along with the type of plastics. This will give us the depth of data based on which policy direction can be concentrated.

b. Deposits on plastic packaging:

Germany and six US states are the best examples of this where the recycling rates of PET bottles shot up to more than 80% within two years of the change in legislation.

c. Increase in landfill taxes:

This is more relevant where the private companies collect household waste, supply them to Material Recovery Facilities who in turn supply the recyclables to the recycling companies. Basically, it works best where the Government can pass on the cost of waste collection to the households.

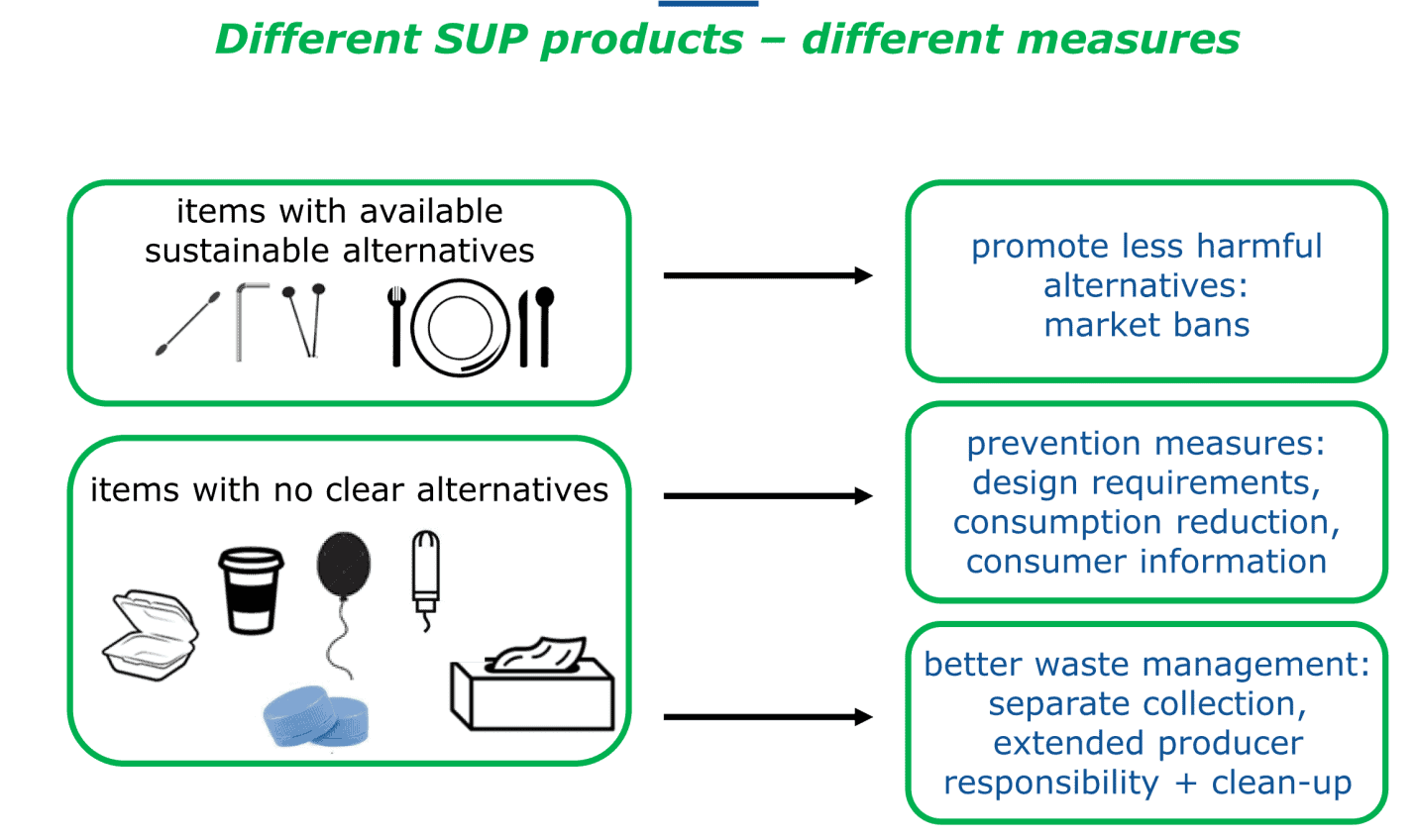

d. Bans on the use of Single Use Plastics and other discretionary plastics:

In EU and several other countries, non-essential Single Use Plastics are either being banned or have been asked to move to more recycling-friendly formats. (EU has a specific regulation for Single Use Plastics).

Source: EC Directive (EU) 2019/904

Countries in Asia are also passing similar regulations. For e.g. India and Indonesia have already banned the use of plastic bags, Thailand has asked for a voluntary non-usage.

e. Policy lead commitments for Recycled content:

EU has successfully encouraged the consumer product companies to commit on the recycled plastic usage in their products. This ensures that there is a demand for recycled plastics irrespective of the price of virgin plastics. This is the best way to encourage recyclers to invest in world class facilities with proper effluent treatment plants.

For example,

- EU’s Circular Plastics Alliance (CPA), has issued a declaration where the signatories will take action to boost the

- EU market for recycled plastics up to 10 million tonnes by 2025.

- UK will impose a tax of GBP 200/ ton tax if packaging has less than 30% recycled content.

Italy has proposed a tax of €450/tonne tax on virgin plastic thereby encouraging companies to use recycled plastics. - Maharashtra government’s recent ruling that all plastic packaging should comprise at least 20 per cent of recycled plastic.

The above measures are especially useful in times when the virgin polymer prices are low. It ensures that recycling activity continues even in these periods.

2. Voluntary action by key stakeholders/ Plastics Pacts:

The Plastics Pact is a network of local and regional (cross-border) initiatives which brings together key stakeholders to implement solutions towards a circular economy for plastic. Each initiative is led by a local organisation and unites governments, businesses, and citizens behind a common vision with an ambitious set of local targets to:

- Eliminate unnecessary and problematic plastic packaging through redesign and innovation

- Move from single-use to reuse where relevant

- Ensure all plastic packaging is reusable, recyclable, or compostable

- Increase the reuse, collection, and recycling or composting of plastic packaging

- Increase recycled content in plastic packaging

- Various countries like Chile, France, Netherland, Polan, Potrugal, South Africa, United Kingdom and USA have already signed the Plastics Pact and have set country targets like below:

Source: https://usplasticspact.org/launch-august2020/

There should be similar Plastic Pacts formulated in Asia as it encourages the participants to contribute to the country’s sustainability targets on a voluntary basis.

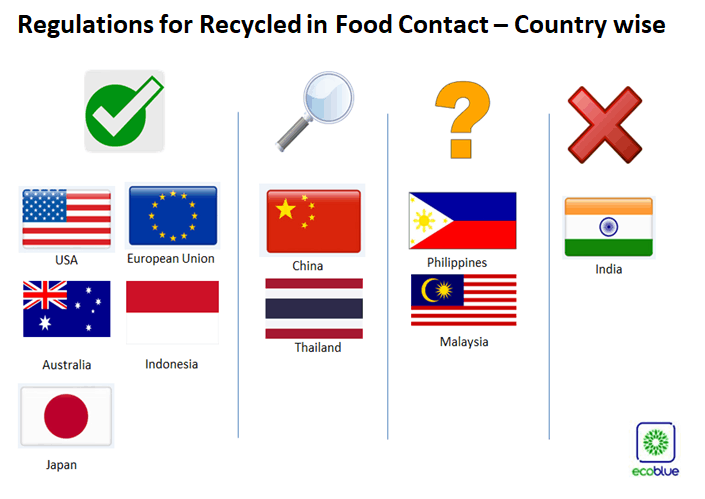

3. Permit Use of Recycled materials in food contact applications:

Most of the developed countries like USA, EU, Japan and Australia and developing countries like Indonesia have allowed use of recycled material in food contact applications. This not only brings the waste materials back into the circular economy but also allows companies to use more sustainable form of packaging. Many Asian countries like Thailand are also evaluating and reviewing the regulations for this which is the need of the hour.

It is good to see that many governments are working on defining the regulations for recycled PET. While the priorities need to be considered, there should be a roadmap for other plastics as well. HDPE as a resin is more widely used for packaging. The FDA regulations being drafted should include both rPET and rHDPE.

4. Standardize quality norms for recycling:

With use of recycled material comes the concern of safety of use and effect on human life and the environment. Non-intentionally added substances (NIAS) in food contact materials represent a major issue for the food packaging or food contact articles and materials industry. Most developed countries have clear methods for testing and defined criteria for qualifying recycled materials as fit for use in direct or indirect food contact applications like the US FDA or EFSA. The Asian countries also need to develop and implement standardized quality norms for NIAS, testing requirements of recycled resin, recycling production processes, waste water treatment etc. This will give confidence to new users of recycled resin about safety of use and be an enabler in increasing the usage of recycled materials.

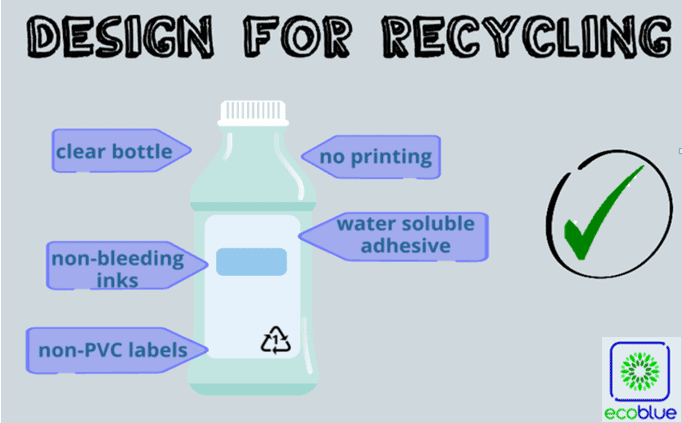

5. Design for Recycling:

Unfortunately, most plastic product design is done not considering sustainability and recycling. Companies continue to use formats which are not just non-recyclable but they also impact the recyclability of other products which could be recycled otherwise. Examples include the use of PVC bottles and sleeves, printed PET bottles and PP cups and so on. Governments should setup bodies to clearly identify product designs which need to be banned over the next few years. This will improve the recycling rates, the quality of the recycled materials and reduce the cost of recycling.

Conclusion: The various factors mentioned above have a direct or an indirect impact on the recycling industry in Asia and they should be considered if the intention is to improve the rate of recycling and the quality of recycling. For this to become possible, collective action is required on part of all the concerned stakeholders – consumers, waste generators, waste collectors, recyclers, industry and government.

Pranay Jain is the Founder & CEO of EcoBlue Limited, Thailand. He has been working on the challenge of providing sustainable solutions for plastics to the industry for the last 10 years. Pranay has worked across geographies and business functions during his rich work experience spanning over 20 years/as a part of his total work experience of over 20 years. Equipped with a Masters’ degree in Finance, he brings with him a clear economic perspective to the problems associated with plastic waste management and recycling. He also holds patents for some of the technologies developed at EcoBlue and is the company’s representative on several international bodies like Ceflex and Petcore. He has a keen passion for sustainability and developing new solutions to achieve the shared vision of a functional circular economy.