With China having displaced the United States as the largest global packaging market, Asia remains packaging’s top growth market. As the use of packaging in Asia continues to soar, so too does the ecological burden, with significant leakage of packaging materials into the environment often as a consequence of lack of waste collection and recycling systems at a scale needed to match strong growth in demand. How is this impacting consumers’ views on sustainability in packaging? To understand this better, we launched a survey across ten countries, including three fast-growing emerging Asian economies (China, India, and Indonesia), to explore consumers’ attitudes. Our findings built on prior work focusing on consumer sentiment globally and an earlier deep dive into consumer sentiment in the United States.

Survey respondents revealed both overarching and more country-specific findings. Three key highlights can be observed. First, consumers in China, India, and Indonesia all feel more strongly than most others about sustainability problems. They also claim to have the highest willingness to pay for green. Second, in all three countries, consumers’ top concerns are centered around water and air pollution and less so around waste production, which is viewed with more concern in other surveyed countries. Echoing our global findings, consumers also perceive sustainable packaging to be a top priority for food-related products; however, the specific food subsegments viewed as most important differ by country. All three generations of consumers surveyed across the three countries are highly concerned about the environmental impact of packaging. Overall, Generation X demonstrates the highest level of environmental concern across different sustainability issues, followed by Gen Zers, millennials, and baby boomers, respectively1 ; however, there is some granular variation. Third, while surveyed consumers align on their perception of the most unsustainable packaging material, country-specific views differ on the most sustainable—similar to global findings. Looking ahead, what consumers wish to see more of is recyclable or compostable plastics films, as well as more fiber-based packaging.

Emerging Asia remains the key growth market for many packaging companies to target. With a strong increase in concern around sustainability, it will become critical to think through the “green narratives” of any growth strategy along with related strategic options. In order to seize the opportunity, we recommend considering three factors in your strategic planning.

Emerging Asia remains the key growth market for many packaging companies to target.

Sustainability concerns rise strongly in emerging Asia

Over the past decade, the global packaging industry has enjoyed steady growth, with the economic boom in emerging Asia being a key growth driver. Headline changes include strong growth of organized retail and increased use of packaging to accommodate consumer demand for convenience. This strong growth in packaging has led to an increased environmental burden due to a frequent lack of the fully developed packaging-collection and recycling systems at a scale needed to manage increased waste.

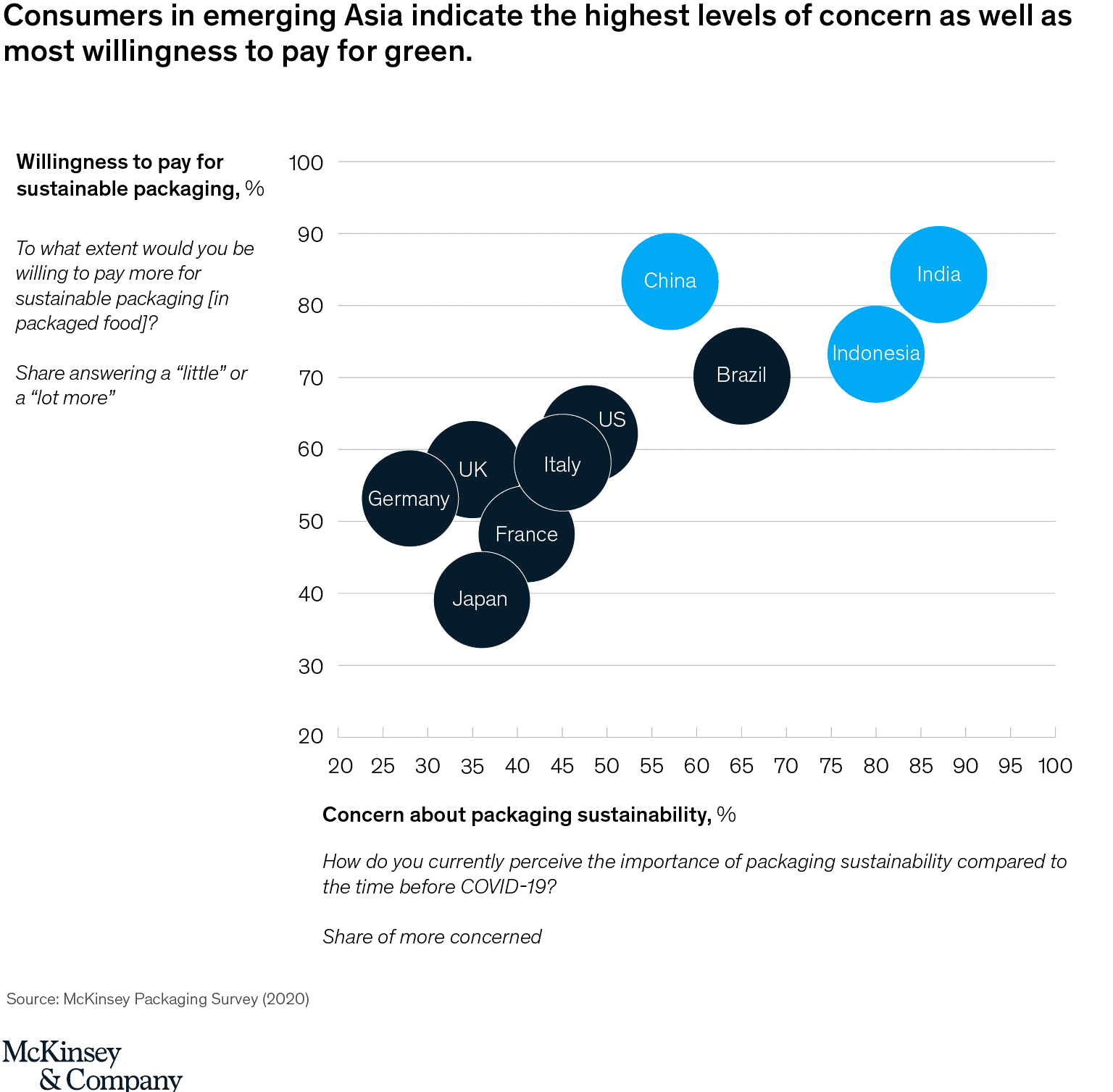

This has not gone unnoticed in the region. Pressure to reduce packaging waste has risen sharply, along with actions by fast-moving consumer goods (FMCG) manufacturers, retailers, and legislators. Despite these measures, consumers in our survey continue to be highly concerned, with respondents in China, India, and Indonesia, together with respondents in Brazil, demonstrating the most concern globally—concern that has increased since the COVID-19 pandemic (Exhibit 1).

There is a similar finding when it comes to consumers’ willingness to pay for green packaging: significantly higher willingness to pay for sustainable food packaging is observed in China, India, and Indonesia compared with other surveyed countries around the world. Similar to those countries, Brazil also shows a high willingness to pay for green compared with the other surveyed countries. This demonstrates the relatively high level of consumer awareness in these markets and the critical need for stakeholders to take action.

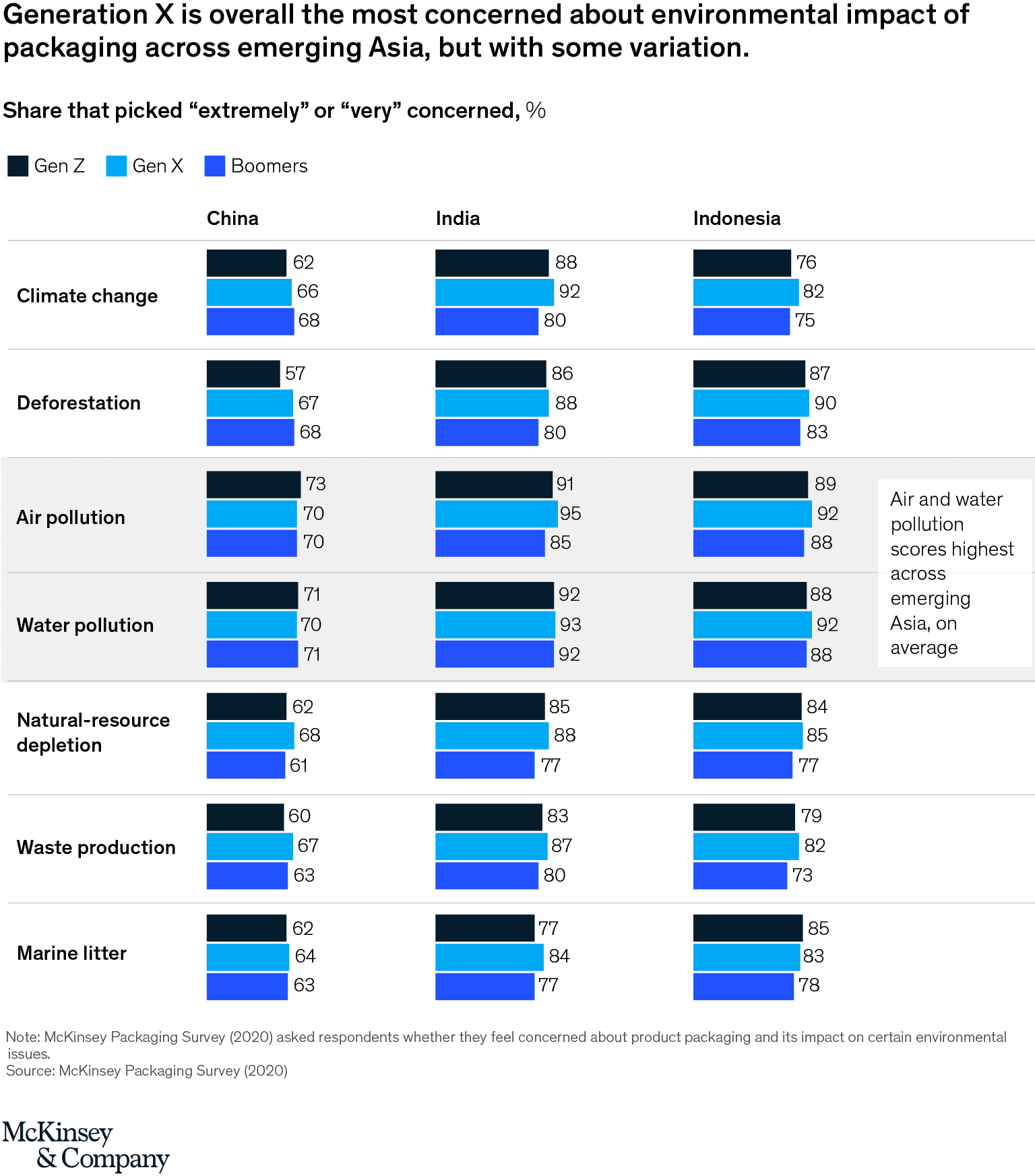

Two further questions related to the above findings then follow: what are consumers in emerging Asia concerned about, and who is driving that increased concern? On the first question, views across the three countries in focus are quite aligned: consumers perceive water and air pollution as key areas of concern. This differs from other surveyed countries, such as Japan, and in Europe where marine litter is perceived as a higher concern. Consumers in the United States and the United Kingdom also point out that waste production is a major concern, while India and Indonesia ranked this as one of the least important issues. The categories in which consumers consider sustainable packaging most important differ somewhat between countries—although all focus on food-related products. In China, priority centers on fresh fruit and vegetables, fresh meat, and dairy products. In India, the highest importance is given to fast-food packaging, followed by dairy products and pet food. Indonesia ranks beverages highest, followed by dairy products, and fresh fruit and vegetables.

Would you like to learn more about our Paper & Forest Products Practice?

When looking more closely into the second question—who is driving the increase in concern—we find that actually all consumer groups are concerned. Overall, Gen Xers show the highest levels of concern, followed by Gen Zers and millennials, and baby boomers (Exhibit 2). Looking at the two key areas of concern—air and water pollution—Generation X is particularly concerned in Indonesia, while there is more variance in China and India.

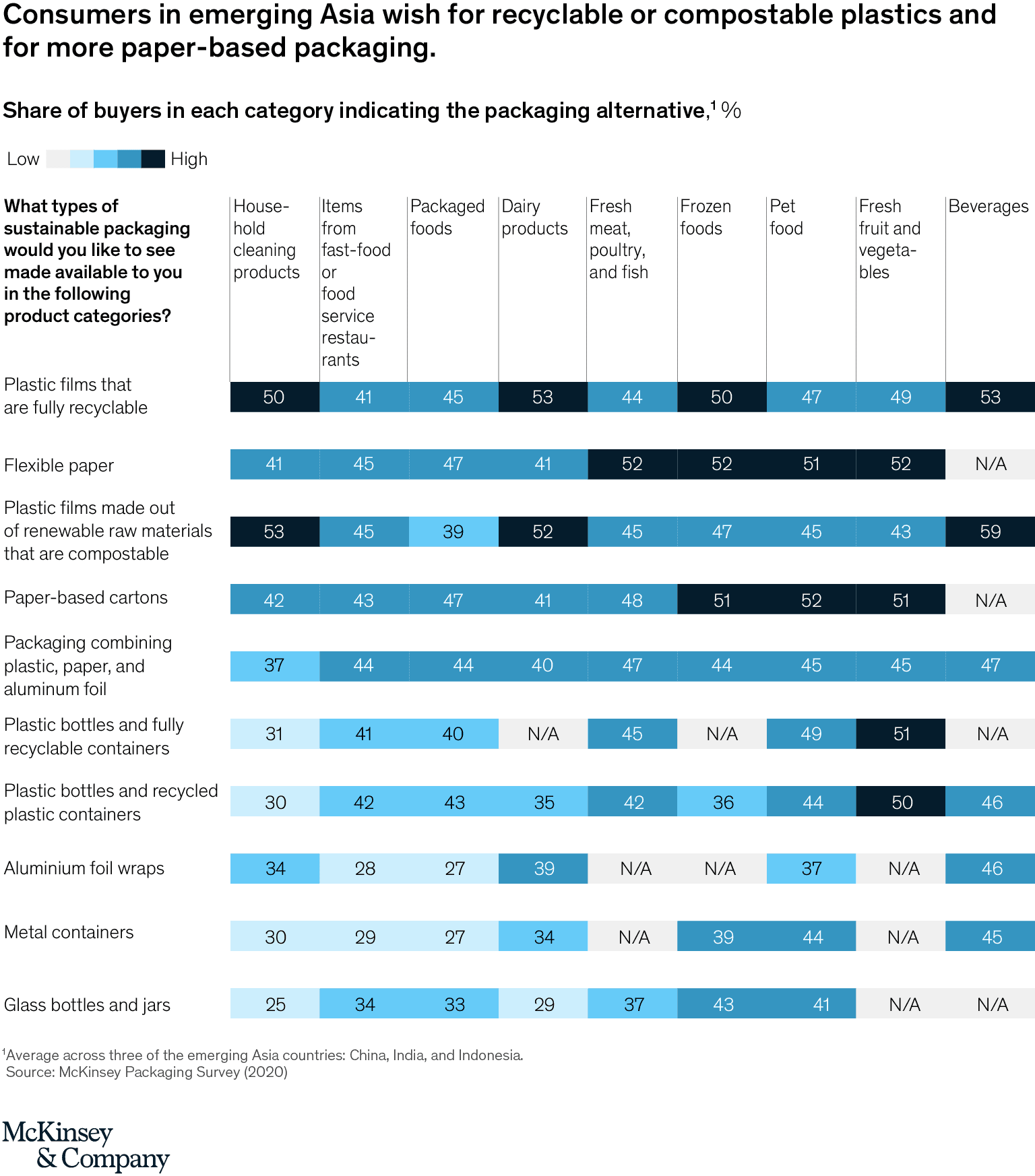

Our survey indicates that consumers around the world disagree about what they see as the most sustainable packaging materials; however, there is more consensus on what they regard as the least sustainable materials. Among our focus countries, consumers in China and Indonesia perceive plastics that are either compostable or recyclable as being more sustainable (a view similar to that of Brazilian consumers). This differs from consumers in India, who perceive paper and glass as more sustainable. Overall, consumers are looking for more recyclable or compostable plastic films and more paper-based packaging (Exhibit 3). Recyclable, rigid plastics rank quite low, and so do both glass and metal.

Many packaging companies target emerging Asia as a vital growth vector, and they also need to develop strategies for success. Examples include identifying opportunities to serve the target market (for example, high-end market versus mass market); determining which customers to target (multinational versus local); adopting the best strategy (such as unit-cost leadership versus innovation leadership); and approaching growth strategy (organic growth versus acquisitions). However, with a strong rise in sustainability concerns in the region, this will not be enough. Accordingly, packaging companies should consider three further elements:

- First, understand how local consumers use products and dispose of the packaging. Our findings show some common regional themes around sustainability, particularly linking high awareness and willingness to pay. There is also an emerging wish among surveyed consumers to see more recyclable or compostable plastic films and paper-based packaging in the future.

Inevitably, when looking at a more granular level, there are multiple differences between the countries and among end-use segments, which require a deeper understanding of the focus markets. Therefore, there isn’t a collective regional solution for determining what packaging will work best and what sustainability levers to pull. In most cases, we suggest using the emerging cross-country themes as a base view supplemented by granular field research to further inform strategic planning. This should include comprehensively mapping out cradle-to-grave packaging journeys from filling to usage and disposal. Such insights will serve as a starting point for understanding the strategic options that exist around the fit of the packaging for a given value chain and the range of improvement levers available. - Second, take an incremental approach, and act sooner rather than later. Even with the indicated high willingness to pay for green, this doesn’t necessarily translate into real consumer action. On top of that, consumers may not always know what to expect or exactly what they want. Given the high urgency to act, we therefore suggest considering available “low-hanging fruit” actions initially. These should be actions that can be taken with little to no impact on operating costs or capital-expenditure needs, functionality, or attractiveness of the packaging. For example, decrease complexity, remove unnecessary use of packaging, conduct a light redesign to improve recyclability, and, where possible, consider material substitutions for more mono-materials. Once these actions have been successfully implemented, companies can then consider addressing system-level changes that require in-depth value-chain collaboration.

- Third, ensure clear communication around sustainability narratives for both product and packaging. It is apparent from our survey that consumers would be willing to buy more sustainable products if they knew what they were buying. Ensuring that the packaging can communicate the sustainability narratives relevant to local consumer concerns will be essential. Also, in the context of increased local and global regulation around sustainability, using packaging to further inform consumers about how a product can be recycled will be vital.

Viewing sustainability issues as a key factor in strategic planning will enable packaging companies to determine how sustainability can be used as a differentiator to attract consumer interest and drive growth.

Environmental concerns are top of mind for consumers in emerging Asia. Viewing sustainability issues as a key factor in strategic planning will enable packaging companies to determine how sustainability can be used as a differentiator to attract consumer interest and drive growth.