Factors such as growing population, increasing income, burgeoning middle class, strong growth in organized retail and surge in e-commerce are driving the demand

Changing the lifestyle of consumers along with rising demand for products that offer ease of convenience are the key attributes prompting the demand for portable packaging solutions. The packaging sector in India is expected to increase from 307.8 billion units in 2019 to 422.3 billion units in 2024, at a compound annual growth rate (CAGR) of 6.5% during 2019-2024, says GlobalData, a leading data and analytics company.

GlobalData’s report, India Packaging Industry Trends and Opportunities, reveals that the sector is majorly driven by growth in the paper & board packaging, which is forecast to register the fastest volume CAGR of 7.8% during 2019-2024. The category is followed by rigid metal, which is expected to record a CAGR of 7.1% during the next five years.

Anchal Bisht, the Consumer Analyst at GlobalData, says: Several factors such as growing population, increasing income, burgeoning middle class, strong growth in organized retail and surge in e-commerce are driving the demand for packaged products and are fueling the growth in the Indian packaging sector. Increasingly busier lifestyles are resulting in a surge in the demand for products that offer convenience and portability, and simultaneously those render enhanced shelf life.

Food industry characterized the most use of packaging in India and accounted for 56.5% market share. It was followed by non-alcoholic beverages and cosmetics & toiletries industries with shares of 25.5% and 3.9%, respectively.

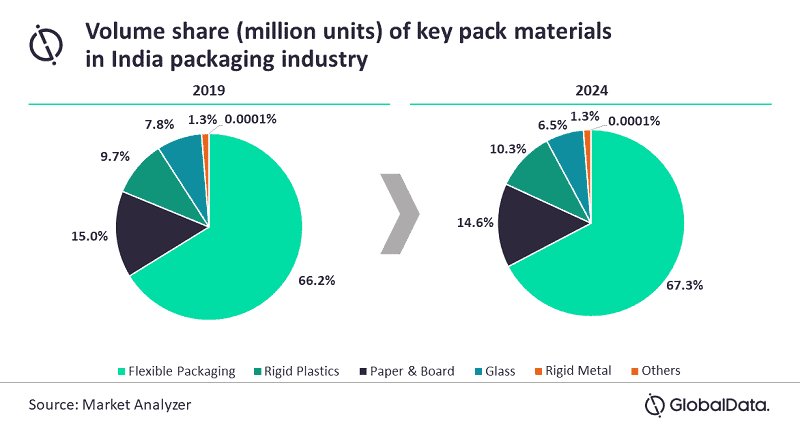

Flexible packaging was the most consumed pack material in Indian packaging and accounted for a market share of 66.2% in 2019. It is expected to reach 67.3% by 2024. Rigid plastics and paper & board were the other popular pack materials.

The food industry was leading in terms of usage of flexible packaging, with a share of 68.1% in 2019. It was followed by non-alcoholic industry which accounted for a share of 18.5% in the same year.

Anchal concludes: Aesthetic appeal of products is increasingly becoming a key differentiating factor among products. Rising urbanization and disposable incomes are translating into growing opportunities for ready-to-consume food and drinks as well as cosmetics & toiletries that address aspirational needs of the growing middle-class population. Cut-throat competition, however, is prompting manufacturers to focus on improving the visual appearance of their products and thereby, consumer attention, mainly via packaging, to drive growth.

Packaging 360 is a comprehensive knowledge sharing ecosystem for the Indian packaging industry. Our services include an online content platform to deliver news, insights and case studies; organising conferences seminars and customised training; Providing Bespoke Project Consulting, Market Research and Intelligence.