AMI, Bristol, 26/09/22 – A new report from AMI Consulting provides critical insight and analysis of the current state of play and future outlook for the collation shrink film market in Europe. The report reviews the supply and demand picture by country and gives an in-depth update on end use application trends, resin developments and their influence on growth dynamics.

Traditionally utilised to fulfil a secondary transit packaging role, recent years have seen collation shrink develop a strong point of sale presence to provide customer convenience when buying multiple items as well enhancing on-shelf appeal with full face printing opportunities.

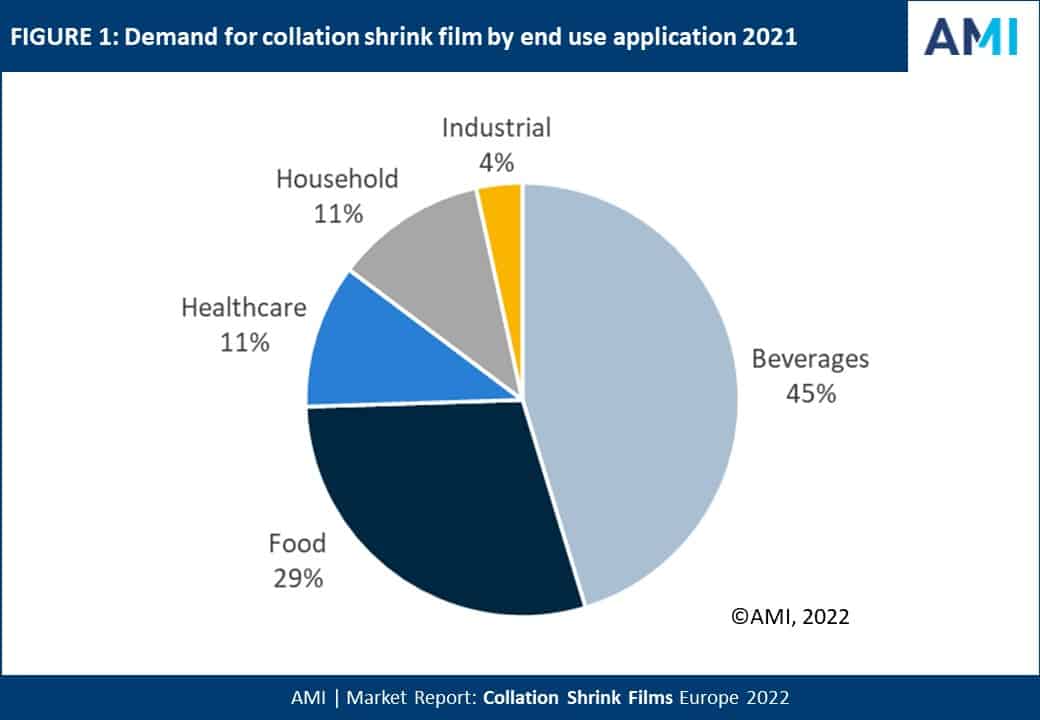

Packaging for alcoholic and non-alcoholic beverages is by far the largest end use application for collation shrink film, followed by food. However, film suppliers to these categories are facing growing competition from cartonboard alternatives for point of sale packs which several major brand owners have switched to in the face of continuing consumer anti-plastic sentiment. For the same reason, for some products collation shrink films are being removed entirely, with a multi-buy discount applied at the till point. The report explores how these factors and others are influencing market demand by application.

The European market is facing a tumultuous period. Challenges include the aftermath of the Covid-19 pandemic, new sustainability-driven regulations, polymer shortages, logistics challenges and changes to retail channels. The war in Ukraine is adding further complications and inflationary pressure. These soaring costs are likely to reduce discretionary consumer spending across many categories, although it may benefit cheaper, staple products such as canned foods which in turn could drive collation shrink usage.

In the past decade, demand for collation film has been heavily influenced by the continuing shift from monoextrusion to 3-layer coextrusion and further product enhancement by moving from 3-layer to 5-layer coextrusion. This has permitted tailor-made use of enhanced metallocene resins in combination with other more established raw materials in order to maximise gauge reduction. Downgauging of virgin resin film has reached its limits in many applications, with future innovation expected to be focused on achieving thinner films whilst maintaining 30-50% post-consumer recycled (PCR) resin content.

Collation shrink films are an ideal candidate for the incorporation of PCR as they are non-food contact. Recyclate should continue to take share from virgin LDPE, although at a lower pace than the industry may anticipate. Whilst brand owners will increasingly seek to use recyclate to satisfy internal mandates and country legislation, limited availability of high-grade PCR resin will constrain usage and subsequent volume growth over the forecast period.

AMI’s Collation Shrink Film in Europe 2022 report is the result of an extensive research programme, providing a comprehensive independent assessment of this industry in times of uncertainty. The authoritative report quantifies capacity, production and demand for collation films by country and end use applications, with a historical context and a five-year forecast.

Company Press Release

Packaging 360 is a comprehensive knowledge sharing ecosystem for the Indian packaging industry. Our services include an online content platform to deliver news, insights and case studies; organising conferences seminars and customised training; Providing Bespoke Project Consulting, Market Research and Intelligence.