AMI, Bristol, 11/10/2022 – AMI has published its 4th authoritative report mapping the global Single Serve Capsules industry. The report aims to support the development of robust participation strategies by equipping industry players and investors with a comprehensive understanding of scale of potential for future development, growth dynamics per system, market drivers and competitive pressures.

Over 80 billion capsules were filled in 2022 globally, both aluminium and plastic formats. Single serve capsules are a dynamic market segment with a complex value chain. The changes in this industry are fast, and driven by growing sustainability pressures and end-of-life scenarios, brand positioning as well as organic consumption trends.

The context of 2020-2021 pandemic lockdowns boosted the demand for single serve capsules in Europe and North America. Both retail and online sales of capsules sharply increased, anecdotal industry feedback being 30-50% growth in lockdowns. Operationally, throughout the first 2 lockdowns filling was working at near capacity and in shifts to assure safety of personnel. Some SKUs were sold out, which was to do with prioritisation of lines and optimal operations to limit changeover times. The second half of 2021 and 2022 resembled more of a normal sales pattern, and the spikes in consumption had settled down. The growth is now largely slowing down.

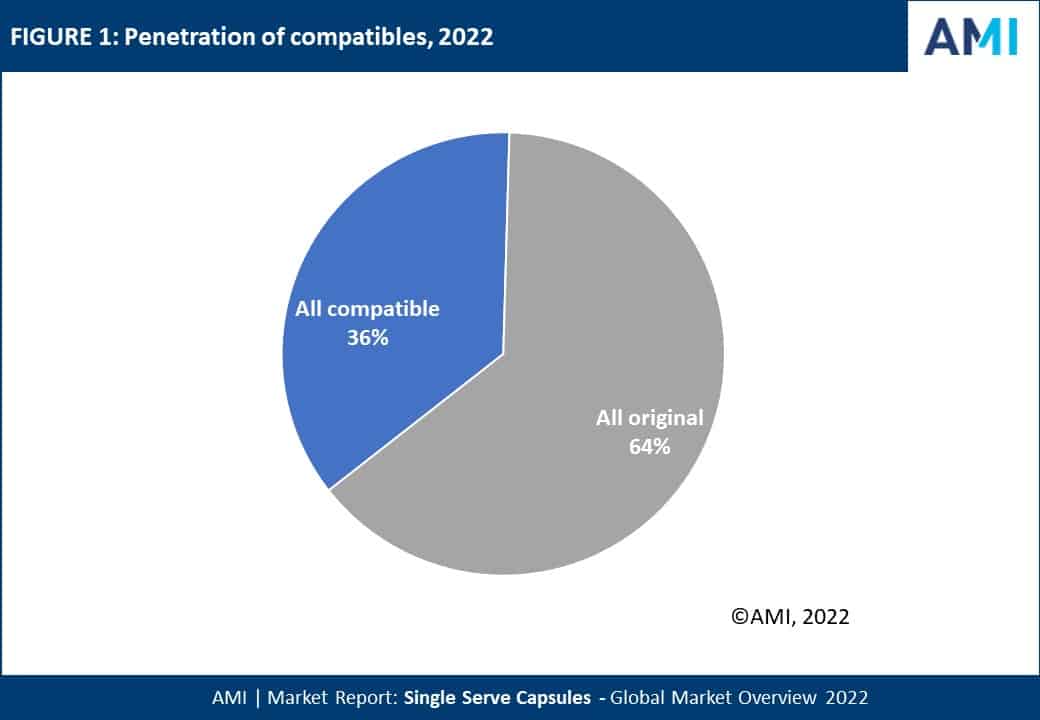

Unlike previously, there was a significant volume increase for original capsules between 2020 and 2022. Nestlé has been managing its portfolio of products extremely well – increasing sales of Nespresso via the Starbucks brand, which was popular in conventional retail. Still, the share of compatible capsules is rising. The Nespresso compatibles include both private label (retailer own brand) and branded offering (L’Or, Café Royal, Dallmayr Capsa).

The compatibles’ need for differentiation resulted in capsule material and barrier spec adjustments, impacting positioning. To this end, L’Or was successfully relaunched in aluminium capsules in 2017. Given L’Or’s aluminium victory, post 2018 the market had gone through the process of dramatic transition from plastic to aluminium Nespresso compatibles.

The growth of aluminium was a result of both the organic growth of consumption of Nespresso and Nespresso compatible capsules buoyed by system rationalisation, but also by inter-material substitution trend away from high barrier plastics in particular. As previously experienced with plastic Nespresso compatibles, there is a current need for differentiation of aluminium compatibles. This can be delivered with aesthetics – not only a variety of lacquers, but also embossing, design features, pre-printed patterns, etc.

The aluminium opportunity had beckoned new entrants and the competition has intensified.

For more information please contact: Martyna Fong, Director, Market Intelligence, AMI martyna.fong@ami.international

Company Press Release

Packaging 360 is a comprehensive knowledge sharing ecosystem for the Indian packaging industry. Our services include an online content platform to deliver news, insights and case studies; organising conferences seminars and customised training; Providing Bespoke Project Consulting, Market Research and Intelligence.